Advertisement

It wasn't long ago that the tech industry was seen as a secure place to work. Between generous salaries, endless snacks, and flexible remote work setups, these jobs seemed untouchable. Yet, the last couple of years have shown a different side. Thousands of tech workers, engineers, designers, recruiters, and product managers have found themselves jobless in waves of layoffs.

Companies that were once hiring aggressively are now cutting roles by the hundreds or even thousands. The question that keeps coming up is: why? Why are companies with billions in revenue letting people go so frequently and suddenly?

A major reason for the current layoffs can be traced back to the decisions made during the pandemic. When lockdowns began, people turned to technology more than ever. Businesses went remote, e-commerce spiked, streaming services became essential, and online tools saw record usage. In response, tech companies rushed to expand. They hired quickly, assuming the growth was here to stay. Some companies nearly doubled their workforce between 2020 and 2022.

That growth turned out to be temporary. Once people returned to offices, stores, and in-person experiences, the demand for many digital services softened. Revenue projections missed the mark. That’s when reality hit: many companies had overhired. With growth slowing, profits under pressure, and investor expectations changing, layoffs became the go-to fix.

This wasn't limited to small startups either. Major players like Meta, Amazon, Google, and Microsoft all trimmed their teams. They didn’t just cut underperformers; entire departments vanished. Some roles were automated. Others were simply no longer part of a revised strategy.

Another key piece of the puzzle is the broader economic climate and how it’s changed what investors expect from tech companies. During the pandemic, low interest rates gave tech firms freedom to grow fast without needing immediate profits. Investors wanted user growth, product expansion, and market share. That tolerance has dried up.

Now, with rising interest rates and inflation, investors want leaner operations and clear paths to profit. They’re no longer excited by unproven bets or bloated payrolls. Public companies are being pressured to show efficiency, not just ambition. Startups, too, are feeling this. Venture capital has slowed, and many early-stage companies are realizing they can’t keep burning cash hoping for another funding round.

This shift affects how leaders make decisions. Instead of investing in long-term innovation or “moonshot” ideas, many are pulling back to protect short-term earnings. In these conditions, jobs that once seemed like investments—research teams, internal tools, recruiting staff—are now seen as costs.

The rise of AI is another factor reshaping how tech companies think about staffing. While artificial intelligence hasn’t replaced entire departments overnight, it's reducing the need for certain roles. Customer support teams are being downsized thanks to chatbots. Coding assistants are reducing the number of developers needed on some projects. Content moderation and analysis are becoming more automated.

This doesn’t mean AI is directly responsible for every layoff, but it’s certainly changing workforce planning. Companies are asking: if a task can be handled by software, why keep a person on payroll to do it?

AI is also shifting the types of skills that are valued. Workers who only maintain legacy systems or specialize in narrowly defined roles are being replaced by fewer, more cross-functional team members who can adapt quickly. In this new environment, generalists with strong technical and business understanding tend to be favored.

Not all layoffs are simply cost-cutting. In many cases, companies are using this moment to restructure. They’re not just reducing headcount—they’re changing direction and rethinking how teams are organized, which roles truly matter, and which efforts align with long-term priorities. This includes killing off old projects, merging departments, or pulling out of regions where growth isn’t promising.

Take Google’s move to focus more tightly on AI, or Meta’s “year of efficiency” strategy that redirected the company’s focus toward building foundational technologies instead of expanding teams. These are cases where layoffs are a side effect of strategy shifts. These moves aren’t always about failing; they’re about adjusting to where leadership believes the future is going and reallocating talent to fewer, more defined goals.

Startups are doing the same, though usually with more pressure. Some early-stage companies are pivoting to entirely new business models and cutting staff who no longer fit that direction. Others are reducing team sizes to buy more time—preserving runway in the hopes of reaching profitability before funds dry up. Survival often depends on making hard calls early.

Recruitment teams are often among the first to go, especially in companies that have frozen hiring altogether. When a company isn’t growing its headcount, it no longer needs a large hiring staff. It’s a clear example of how internal functions are the first to be hit, even if the company isn’t in obvious financial trouble or showing external signs of distress.

The tech industry is undergoing a reset. Not a collapse, but a recalibration. After a decade of near-uninterrupted growth, easy capital, and fast hiring, companies are being forced to operate under more disciplined rules. Overhiring during the pandemic years set up a bloated workforce that couldn’t be sustained once demand cooled and financial conditions changed. On top of that, AI and automation are pushing companies to rethink how they build their teams. These layoffs aren’t about one issue—they’re the result of several forces converging: misjudged growth, economic shifts, changing investor demands, new technology, and internal restructuring. It’s a sharp contrast from the promises and optimism of just a few years ago. Whether this new reality sticks around will depend on how the next wave of innovation plays out—and how companies choose to adapt to it.

Advertisement

Can small AI agents understand what they see? Discover how adding vision transforms SmolAgents from scripted tools into adaptable systems that respond to real-world environments

Curious how LLMs learn to write and understand code? From setting a goal to cleaning datasets and training with intent, here’s how coding models actually come together

How AI middle managers tools can reduce administrative load, support better decision-making, and simplify communication. Learn how AI reshapes the role without replacing the human touch

What's fueling the wave of tech layoffs in 2025, from overhiring during the pandemic to the rise of AI job disruption and shifting investor demands

Discover ten easy ways of using ChatGPT to analyze and summarize complex documents with simple ChatGPT prompts.

Struggling to connect tables in SQL queries? Learn how the ON clause works with JOINs to accurately match and relate your data

Learn the top 5 AI change management strategies and practical checklists to guide your enterprise transformation in 2025.

The era of prompts is over, and AI is moving toward context-aware, intuitive systems. Discover what’s replacing prompts and how the future of AI interfaces is being redefined

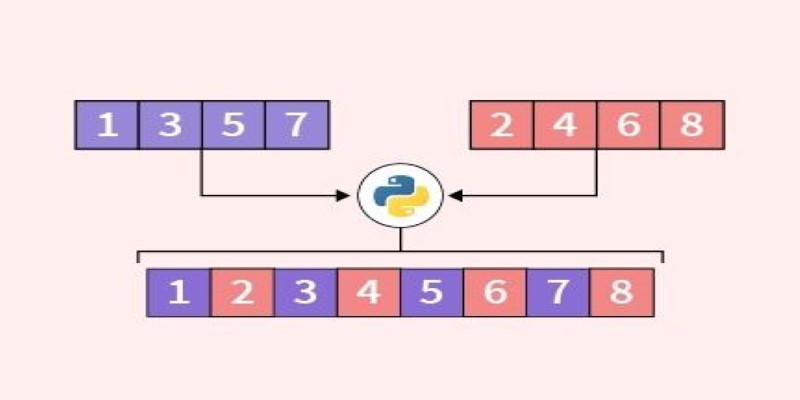

Looking for the best way to merge two lists in Python? This guide walks through ten practical methods with simple examples. Whether you're scripting or building something big, learn how to combine lists in Python without extra complexity

How Edge AI is reshaping how devices make real-time decisions by processing data locally. Learn how this shift improves privacy, speed, and reliability across industries

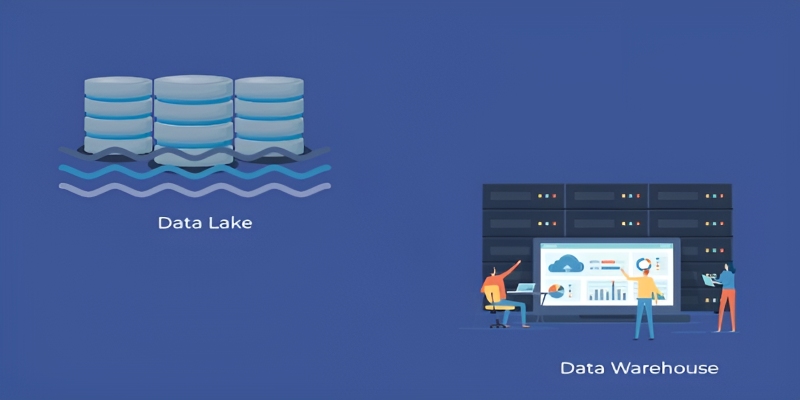

Wondering whether a data lake or data warehouse fits your needs? This guide explains the differences, benefits, and best use cases to help you pick the right data storage solution

Snowflake's acquisition of Neeva boosts enterprise AI with secure generative AI platforms and advanced data interaction tools